The numbers are in for Intel’s fourth quarter and full-year 2022 outcomes, and so they’re not significantly fairly when put in context. Intel’s fourth quarter income settled at $14 billion, and whereas that is not chump change by any stretch of the creativeness, it is a large 32 % drop in comparison with the identical quarter a yr in the past. It additionally resulted in a $684 million web loss for the quarter, which practically matches its largest loss ever ($687 within the fourth quarter of 2017).

Intel’s full-year outcomes for fiscal 2022, in the meantime, tallied $63.1 billion in income, which marks a large 20 % drop in comparison with 2021. On the intense facet, Intel nonetheless ended the yr $8 billion within the black, although that is a large 60 % decline from the $19.9 billion revenue it posted the earlier yr.

“Regardless of the financial and market headwinds, we continued to make good progress on our strategic transformation in This fall, together with advancing our product roadmap and enhancing our operational construction and processes to drive efficiencies whereas delivering on the low-end of our guided vary,” Gelsinger stated in a press release.

“In 2023, we’ll proceed to navigate the short-term challenges whereas striving to satisfy our long-term commitments, together with delivering management merchandise anchored on open and safe platforms, powered by at-scale manufacturing and supercharged by our unimaginable workforce,” Gelsinger added.

Trying past the numbers, Intel highlights its technique of launching 5 nodes in 4 years. To that finish, Intel 7 has reached excessive quantity manufacturing, Intel 4 is prepared for manufacturing, Intel 3 is on observe, and each Intel 20A and 18A have taped out with silicon within the lab, the corporate says.

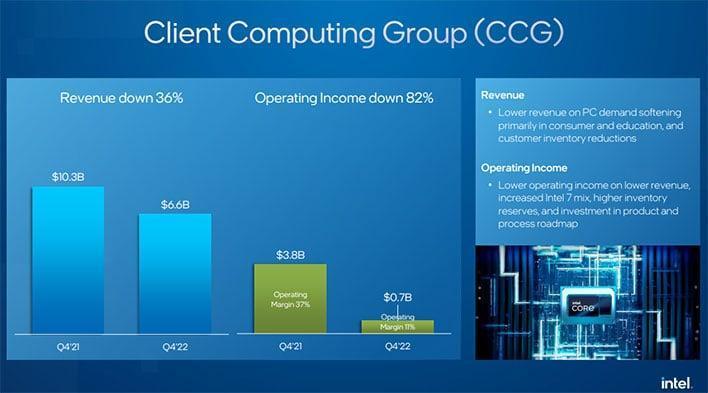

Be that as it could, the losses cannot be ignored, given the steep declines amongst Intel’s largest earners. Income for its Consumer Computing Group tallied $6.6 billion within the fourth quarter, which is a 36 % decline year-over-year, whereas its Knowledge Middle and AI division tumbled 33 % to $4.3 billion.

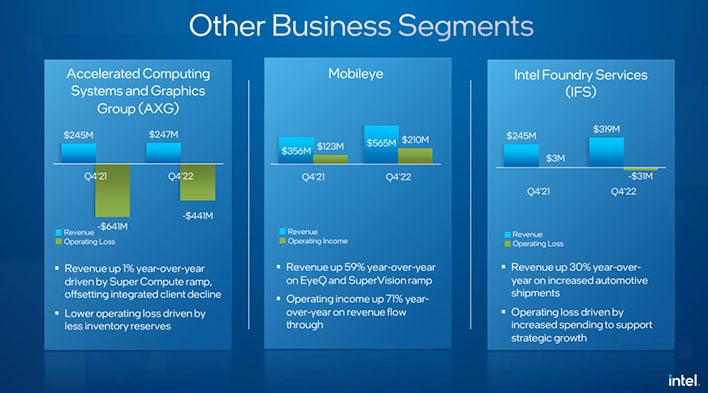

It wasn’t all dangerous, although. Intel’s Mobileye division shot up 59 % to $565 million, and Intel Foundry Companies noticed a 30 % bounce to $319 million, each within the fourth quarter.

“Within the fourth quarter, we took steps to right-size the group and rationalize our investments, prioritizing the areas the place we are able to ship the best worth for the long run,” stated David Zinsner, Intel CFO. “These actions underpin our cost-reduction targets of $3 billion in 2023, and set the stage to realize $8 billion to $10 billion by the tip of 2025.”

A market correction of kinds was all the time inevitable, on condition that the pandemic spurred a bunch of PC upgrades as staff shifted to distant work. Nonetheless, Intel additionally pointed to macro uncertainty, rising rates of interest, geo-political tensions in Europe, and the continued results of Covid in Asia as contributing components. And whereas not particularly talked about, Intel is competing in opposition to a reinvigorated rival in AMD.