Why it issues: Recently, there was important information about China’s Electric Vehicle (EV) trade, primarily regarding its statistics. We predict this development might result in better international commerce points. China has turn into a internet exporter of autos for the primary time in its historical past. They are promoting a whole lot of EVs to the world, and that may reverberate all through the worldwide economic system.

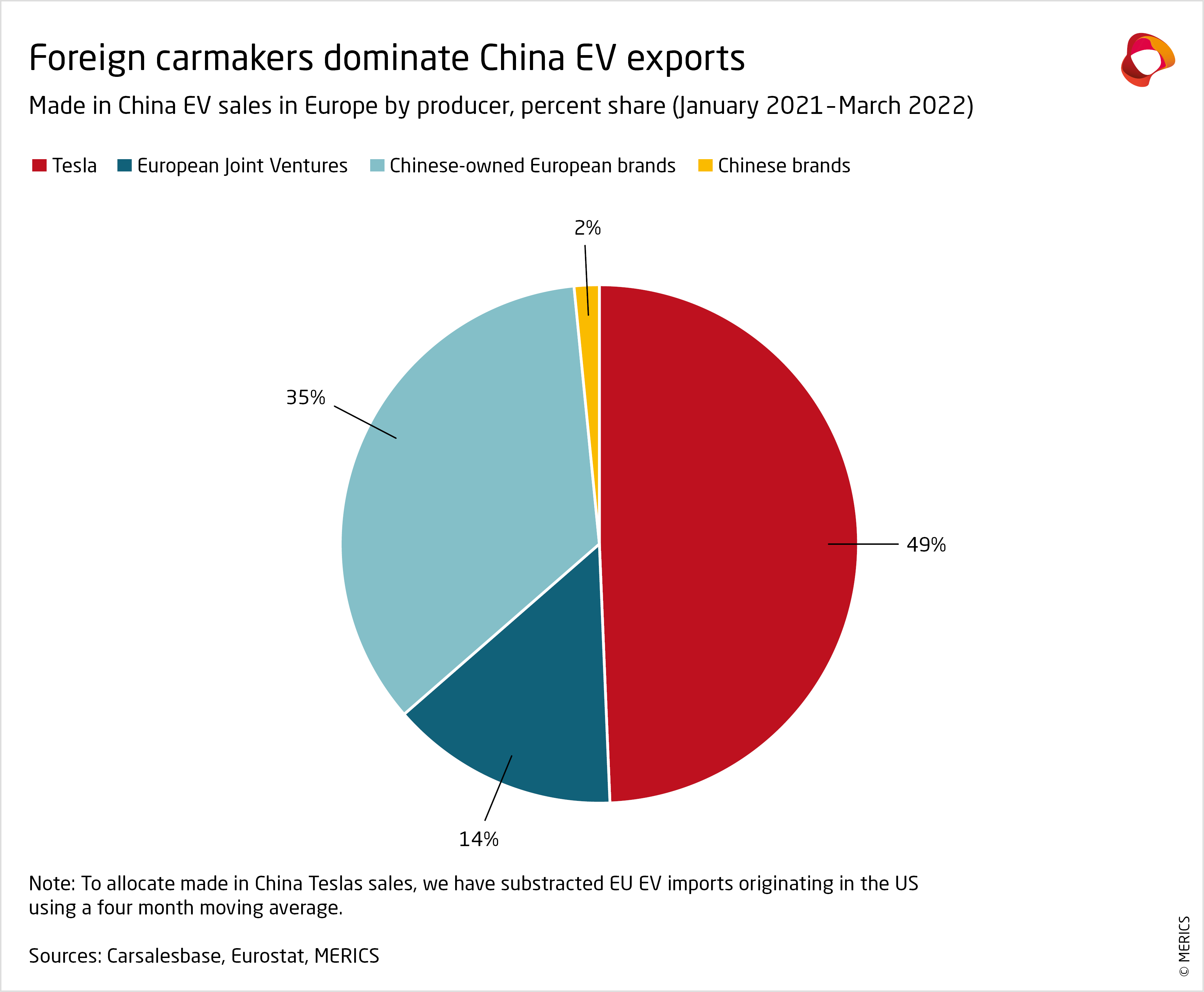

Eurostat, the EU’s statistical company, launched the most recent knowledge on automotive commerce. China now accounts for practically 50% of Europe’s EV imports. To put this in context, Europeans bought about 9 million automobiles in 2022, of which 12%, or 1 million automobiles, had been EVs. Of these, 500,000 originated from China.

Editor’s Note:

Guest writer Jonathan Goldberg is the founding father of D2D Advisory, a multi-functional consulting agency. Jonathan has developed progress methods and alliances for firms within the cellular, networking, gaming, and software program industries.

Further evaluation reveals that about half of those had been China-made Teslas, with the remaining primarily being different Chinese manufacturers. We have derived this knowledge from Eurostat, DW, an insightful report from EU-China assume tank Merics, and the Financial Times.

This improvement has led to a considerable shift in commerce between Europe and China. China represents an necessary marketplace for European automotive producers. For years, they’ve engaged in joint ventures in China to provide low and mid-priced autos, which means most of those exports had been luxurious automobiles. The commerce steadiness was beforehand round $3 billion to $5 billion in Europe’s favor. However, over the previous two years, with a major acceleration previously 12 months, the steadiness has shifted. It nonetheless favors Europe, nevertheless it has fallen to roughly $2 billion. Almost all of this shift is attributed to EVs.

China is clearly on the rise, not simply in EV manufacturing, however as a serious participant on the worldwide export stage. We warned about this in January, and proof of this rise is changing into more and more distinguished in commerce knowledge. From a broader perspective, economist Brad Setser not too long ago tweeted knowledge displaying the surge in China’s general automotive exports previously 12 months. China is now a internet exporter of automobiles most likely for the primary time in its historical past, and most of this progress is attributed to electrical automobiles.

This transition carries necessary implications. The most blatant is the potential escalation of commerce tensions. The US and China have been in a commerce warfare for a number of years, and we consider this newest knowledge considerably raises the chance of the EU getting concerned.

The tempo at which China has emerged as a serious auto exporter – and now a serious internet exporter of autos – is beautiful.

1/3 pic.twitter.com/Fk7qNapAkb

– Brad Setser (@Brad_Setser) April 25, 2023

Secondly, one in all China’s main weaknesses in its ascent to manufacturing prominence this century has been its firms’ incapability to determine manufacturers. Many shoppers buy quite a few Chinese-made merchandise, but we will identify fewer than a dozen Chinese manufacturers recognizable to shoppers exterior of China. These notable exceptions embody smartphone manufacturers like BBK’s Oppo, Vivo, One Plus, Xiaomi, and Transsion’s varied manufacturers. Brand homeowners can command a bigger share of worth, and the power to attain globally acknowledged manufacturers represents a major step in financial improvement. Chinese automakers now seem like conducting this in one of many wealthiest industries.

To relate this again to semiconductors, we consider this commerce knowledge carries two necessary implications. First, as now we have detailed extensively, EVs require a major variety of semiconductors. Except for Tesla, most of China’s EVs are pretty low-priced, however even these autos necessitate substantial semiconductor content material. The low costs are more likely to additional stimulate the transition to EVs, which is usually helpful for the semiconductor trade.

Second, from a commerce perspective, one of many main issues concerning US sanctions on China’s semiconductors has been the willingness of allied international locations to take part. For US sanctions to be efficient, the US authorities wants assist from different international locations, particularly Japan, South Korea, and Europe – all residence to important automotive industries.

We assume it is possible that commerce knowledge like it will encourage these international locations to take discover and be extra accepting of US sanctions. In explicit, Germany, which has appeared considerably immune to the US increasing commerce measures in opposition to China, may rethink its stance with the cornerstone of its industrial mannequin probably in danger.